Based on Fisher Investments UK’s reviews of market history, we think investing globally is sensible for many investors. However, global investing can introduce a unique feature in owning securities from abroad: currency skew. In our view, investors may benefit by understanding its effect on international equity returns.

Currency skew describes the difference in returns on equities you buy denominated in currencies other than your home country’s and those applying to you after conversion. Thanks to modern financial innovations, European investors seeking to purchase foreign companies – like US listings – usually don’t have to move money to an American account, convert their funds to dollars and buy equities. Many companies have depositary receipts – securities representing shares of an overseas company that trade on overseas exchanges and are priced in that country’s currency. For example, depositary receipts listed in London trade in pounds whilst European Depositary Receipts (EDRs) trade in euros. Their returns, to put it simply, are the company’s return in its home currency plus or minus the investor’s home currency’s appreciation or depreciation relative to that currency.

To illustrate this, say a hypothetical investor in Spain owns an EDR of an American company. If the dollar strengthens versus the euro, that will add to the Spanish investor’s return – she will get the equity’s return plus the dollar’s gain. If the dollar weakens versus the euro, it will similarly subtract from her return.

Fisher Investments UK’s reviews of recent market history can help illustrate the impact. Consider 2022’s first half, when the euro and British pound both depreciated significantly against the US dollar.[i] Eurozone and UK investors holding US equities received US equities returns plus the dollar’s appreciation against their respective home currencies. Hence, whilst S&P 500 returns in dollars breached -20.0%, the technical threshold for a bear market (typically a prolonged, fundamentally driven decline of -20% or more), the US-based index fell a more muted -12.9% in euros and -10.7% in pounds.[ii] For investors with these home currencies, the US dollar’s appreciation partially offset overall negative US equity returns.

Conversely, consider US investors holding eurozone equities. These investors received eurozone listings’ returns minus the euro’s depreciation against the dollar. The MSCI EMU fell -24.8% in dollars, a plunge magnified by the dollar’s strength against the euro.[iii] That is evident upon analysing the MSCI EMU’s return in euros: -18.2%.[iv] The index’s euro-denominated returns outperformed dollar-denominated returns by more than six percentage points.

Fisher Investments UK’s review of historical market data finds this same effect plays out globally, with many currencies in the mix – the MSCI World Index tracks equities denominated in 14 respective currencies at the time of writing.[v] Consider: when the Swiss franc spiked against the euro in 2015, MSCI World returns were very different depending on an investor’s home currency.[vi] Whilst the MSCI World full-year return in euros was 10.4% for 2015, the same index returned a slightly negative -0.1% in francs.[vii]

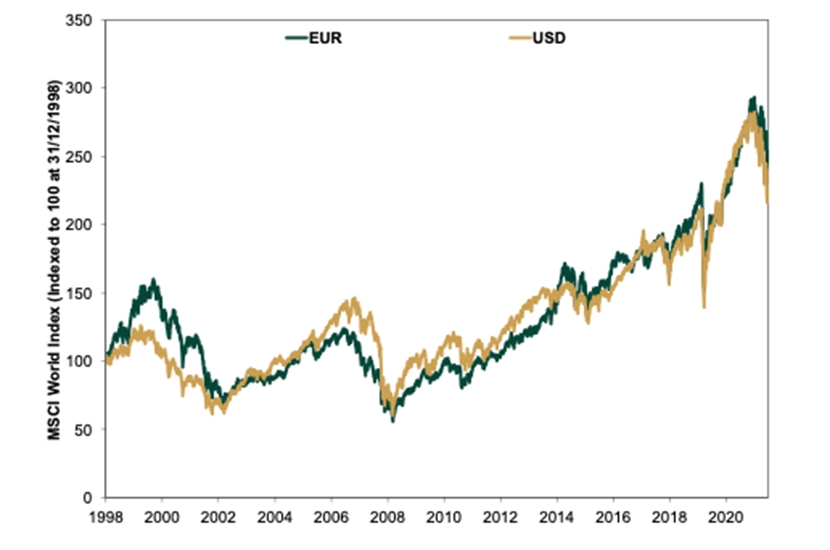

Then, too, also based on Fisher Investments UK’s reviews of historical data, currency skew tends to even out over the longer term. We think comparing MSCI World returns in US dollars versus euros helps illustrate this. Exhibit 1 shows the index’s returns in these currencies since the euro’s introduction in 1999. Over the past 20 years, leadership has fluctuated between euro- and dollar-denominated returns – and they are neck and neck repeatedly.

Exhibit 1: Currency Skew Evens Out Over the Longer Term

Source: FactSet, as of 3/8/2022. MSCI World Index price level in USD and EUR, 31/12/1998 – 30/6/2022. Price returns used in lieu of returns with net dividends due to daily data availability. Presented in US dollars and euros for illustrative purposes. Currency fluctuations between these currencies and the pounds may result in higher or lower investment returns.

We think understanding currency skew – and its short-term nature – may benefit investors. First, recognising currency skew tends to even out over the longer term can help investors see the potential folly in making moves in reaction to short-term currency swings. We don’t think there is a long-term benefit to making equity purchases or sales based on short-term swings – nor is it possible to time short-term volatility consistently, in our view. That applies to timing investments in any given country based on currency skew, too.

Furthermore, we think understanding why returns may look different in an investor’s home currency versus the currencies of other countries may benefit investor psychology. For example, publications Fisher Investments UK declared a world bear market in 2022’s first half. As noted above, that statement was accurate for world returns in US dollars – but not in euros or pounds. Investors with the latter two home currencies may have wondered why their returns looked so different from headlines’ proclamations. Understanding currency skew may help sidestep that kind of uncertainty, in our view – thus allowing investors to remain focused and avoid decision-making based on overconfidence or fear. In our experience, global investors may notice the effects of currency skew to some extent. We think understanding currency skew can help you set rational expectations and ease pressure to make portfolio decisions.

Interested in other topics by Fisher Investments UK? Get our ongoing insights, starting with a copy of Your Net Worth.

Follow the latest market news and updates from Fisher Investments UK:

Facebook: https://facebook.com/FisherInvestmentsUK/

Twitter: https://twitter.com/FisherInvestUK

LinkedIn: https://www.linkedin.com/company/fisher-investments-uk

This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or a reflection of client performance. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Nothing herein is intended to be a recommendation or forecast of market conditions. Rather, it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. In addition, no assurances are made regarding the accuracy of any assumptions made in any illustrations herein. Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom. Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[i] Source: FactSet, as of 12/8/2022. Statement based on exchange rate between the US dollar and British pound, and US dollar and euro, 1/1/2022 – 30/6/2022. Presented in US dollars, euros and British pounds.

[ii] Source: FactSet, as of 12/8/2022. S&P 500 Total Return Index in US dollars, British pounds and euros, 1/1/2022 – 30/6/2022. Presented in US dollars, euros and British pounds.

[iii] Source: FactSet, as of 12/8/2022. MSCI EMU return with net dividends in US dollars, 1/1/2022 – 30/6/2022. Currency fluctuations between the dollar and the pound may result in higher or lower investment returns.

[iv] Source: FactSet, as of 12/8/2022. MSCI EMU return with net dividends in euros, 1/1/2022 – 30/6/2022. Currency fluctuations between the euro and the pound may result in higher or lower investment returns.

[v] Source: FactSet, as of 12/8/2022. Statement based on MSCI World constituent countries’ respective national currencies, as of 1/8/2022.

[vi] Source: FactSet, as of 12/8/2022. Statement based on exchange rate between the Swiss franc and euro, 1/1/2015 – 31/12/2015. Presented in Swiss francs and euros. Currency fluctuations between these currencies and the pound may result in higher or lower investment returns.

[vii] Source: FactSet, as of 12/8/2022. MSCI World Index returns with net dividends, in Swiss francs and euros, 1/1/2015 – 31/12/2015. Currency fluctuations between these currencies and the pound may result in higher or lower investment returns.

This article is free to read

To unlock more articles, subscribe to get 3 months of unlimited access for just $5

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in