Investments in the Financials sector have performed better than the broader equity market in 2022, but some equities in the space remain below price levels leading into the Great Financial Crisis from 2007-2009.[i] Over a decade of lacklustre performance has some investors wondering how to invest in the sector and whether its recent outperformance can continue. In this article, Fisher Investments UK discusses the basics of the Financials sector, what’s impacted its performance in recent years and factors to consider if you are thinking of making a change in your portfolio.

The Financial Sector’s Decline

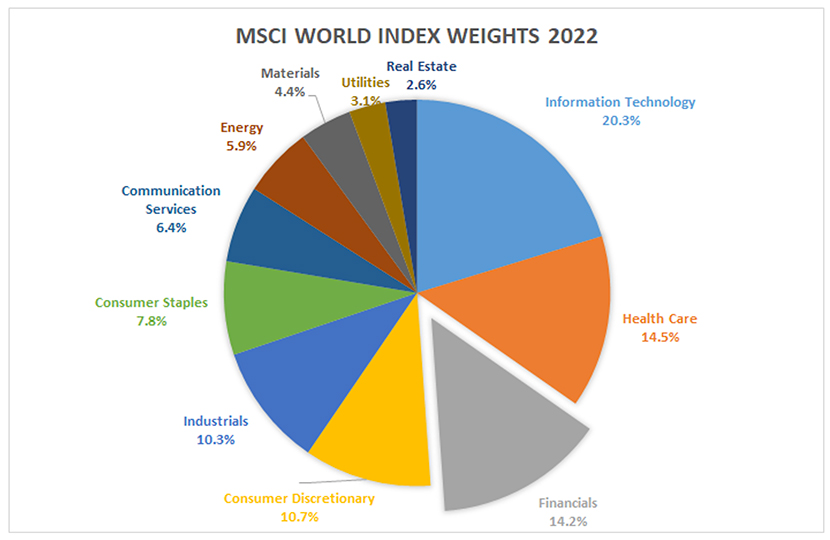

The Financial sector has long been a sizeable part of the equity market, but its prominence has waned following the Great Financial Crisis. Figure 1 shows how the sector composition of the MSCI World Index – a widely used representation of the global developed equity market – has evolved since late 2007. The Financials sector went from being the largest part of the market to the third largest. In order to understand how to approach the Financials sector today, Fisher Investments UK knows it’s important to understand the role financial institutions played in the market’s downturn during the Great Financial Crisis and how investors have treated the space since.

Figure 1: Relative size of the Financials sector shrank from 2007 to present

Whole books have been written on the Great Financial Crisis. Many think its cause was a global housing bubble stemming from an increase of subprime mortgages. Housing certainly played a part, but Fisher Investments UK believes a little discussed accounting rule (FASB 157) – otherwise known as “Mark-to Market” accounting – contributed greatly to the financial distress of the time. This rule required financial institutions to value long-term and difficult-to-price assets, such as mortgage-backed securities, as if they had to be sold immediately when a comparable asset was sold elsewhere. The unintended consequence was a negative feedback loop. If one institution had to write down its assets for any reason, it caused others to write down similar assets simultaneously – which led to more write-downs and enormous pressure on the financial system. Investors watched as some financial firms went bankrupt whilst others brokered deals with governments and competitors for hefty discounts – all leading to extreme uncertainty at the time. FASB 157 was ultimately revised in the beginning of 2009 – near the ensuing recovery’s beginning – which we don’t believe is coincidental timing.

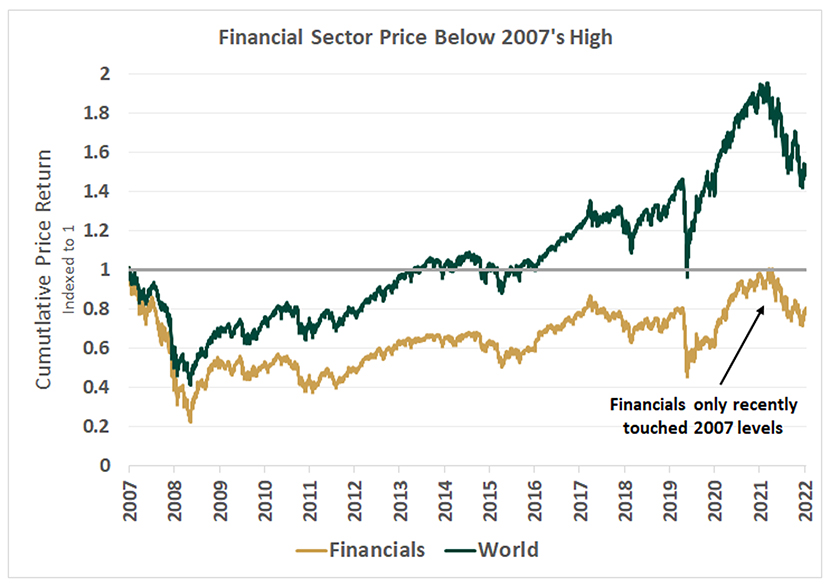

The whole equity market fell precipitously during the Great Financial Crisis – one of modern history’s worst bear markets. However, the Financials sector was the worst performing sector during this time due to its perceived role in the downturn[ii]. As the market began to recover in March of 2009, investors continued to favour other sectors over Financials. This may have been a “hangover” effect from the downturn. For example, Fisher Investments UK’s research suggests the category that was perceived to cause a downturn often underperforms for some time in the recovery. Technology also underperformed for years following the tech bubble collapse in the early 2000’s. However, investors also increasingly became interested in growth-oriented companies whereas the Financials sector more closely tracks “value”, as we’ll explore below. Due to these factors and more, the MSCI World Financials Index price remains below 2007’s high point, as Figure 2 shows.

Figure 2: MSCI World vs. MSCI World Financials since 2007

Financials Sector Industries

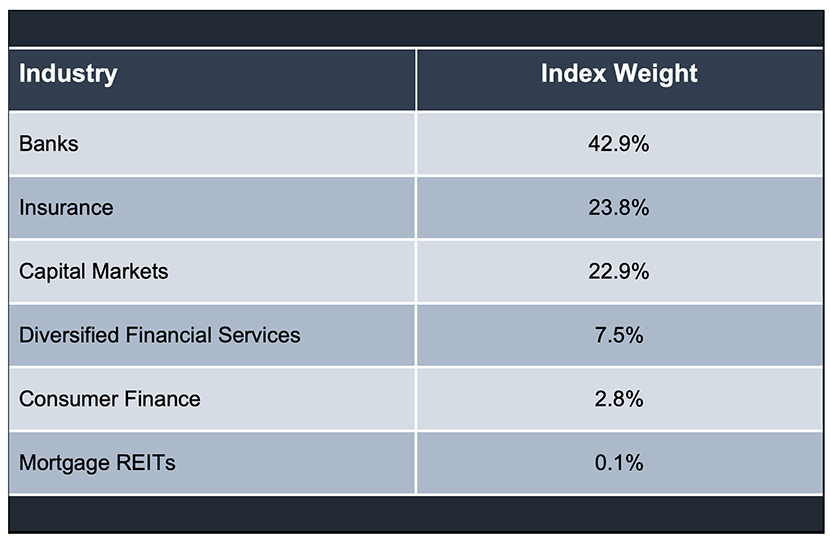

Fisher Investments UK knows that before investing in any part of the market, it’s important to understand the individual factors that can affect an equity’s performance. The Financials sector hosts a myriad of companies with a variety of business models. Figure 3 shows the various industries that make up the Financials sector. Different factors influence the sales and profits of these industries. For example, banks are more likely to be affected by the interest rate environment and lending trends. Capital markets companies – equity exchanges, fund providers, etc. – may benefit when asset prices are broadly rising and the economy is growing. An insurance company’s sales may be less reliant on economic conditions because insurance is a necessity in many areas of life. As very different factors influence these industries, individual equity performance can vary dramatically.

Figure 3: MSCI World Financials Industry Weights

The Financials Sector: Growth or Value?

Some investors have been particularly focused on the “growth versus value” debate in recent years, attempting to determine which category is likely to see better returns ahead. Whilst it’s overly simplistic to split the entire equity market into just two categories, there has been a material divergence between “growth” and “value” returns over the last decade.

A growth equity is typically a company with a business model that allows it to grow faster than the broader economy – usually because it’s exposed to some kind of secular trend such as cloud computing, ecommerce, etc. Because of the higher-than-average growth rates, investors are more willing to pay a premium valuation for shares. Fisher Investments UK knows that growth companies also usually rely more heavily on equity financing than debt and typically reinvest profits for future growth. By contrast, a value company usually has less expensive valuations, distributes more of its profits to shareholders, relies more heavily on debt financing and is slower growing – perhaps because it is exposed to more established, mature trends.

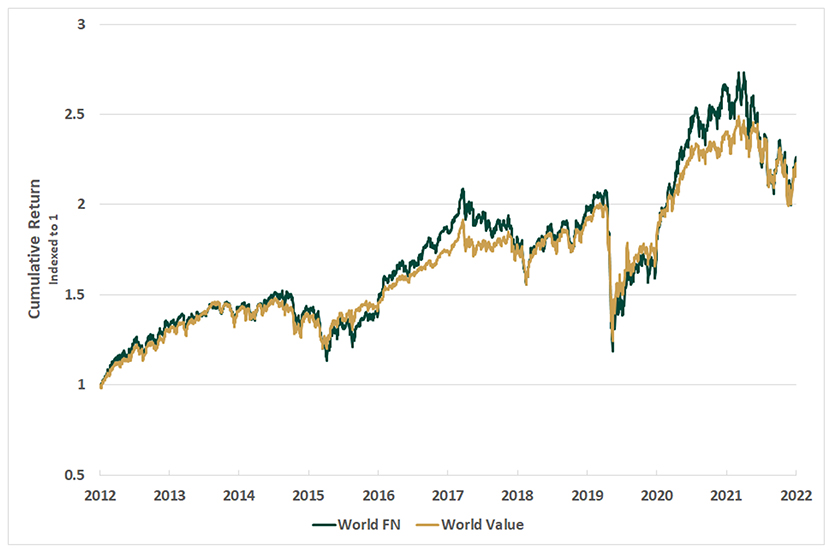

At Fisher Investments UK, we see many investors typically think of the Financials sector as a value sector. Banking, as a business, has been around for a long time and there isn’t as much innovation in the sector as there is in Information Technology, for example. As a result, financial companies don’t tend to grow very quickly and are more likely to return a higher percent of profits to shareholders. As Figure 4 shows, the Financials sector has closely tracked the returns of the broader value equity market for the last decade.

Figure 4: The Financial Sector Tracks Value Equities

What is the Financials sector’s impact on the rest of the market?

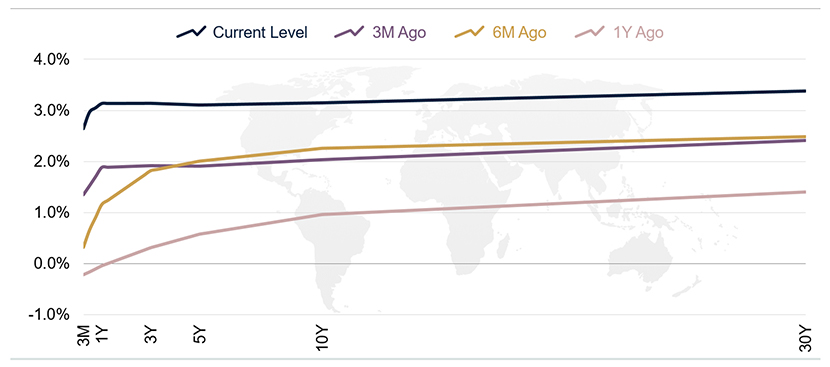

Regardless of your views on how Financials should perform, it’s important to closely follow the sector because financial firms can have a large influence on other sectors and the economy. Financial companies are the foundation of modern society and the services they provide help the economy run. In particular, bank lending is an important driver of economic activity around the globe. That’s why investors focus so much on the “yield curve.” The yield curve is a representation of the interest rates governments are paying on debt of different maturities. At Fisher Investments UK, we believe it’s most useful to look at the global yield curve (Figure 5) because many banks operate and lend globally.

Figure 5: The Global Yield Curve

The yield curve is relevant for financial firms and the economy because it is a proxy for banks “net interest margins” (NIMs) – the difference between the interest rate a bank pays on deposits and the interest rate a bank charges on loans. Investors look to see if the spread between short-term rates and long-term rates is positive. A positive spread suggests banks are incentivized to lend, whereas a negative spread suggests banks may pull back on issuing loans. At present, the yield curve remains narrowly positive, which suggests the recently strong lending environment can continue. In practise, the yield curve is only one piece of the economic puzzle, but is important as it’s been a reasonably reliable forward-looking indicator for markets due to the impact of bank lending on the overall economy.

Should investors adjust their Financials sector exposure?

Fisher Investments UK thinks investors should maintain a well-diversified portfolio aligned with their long-term goals and financial circumstance. Changes to portfolios should be made based on forward-looking views rather than on recent performance. If you are thinking of adjusting your exposure to the Financials sector, we think you should consider the following questions first:

- Which industry in Financials do you want exposure to? Some parts of Financials benefit from rising asset prices whilst other areas are more defensive.

- Do you think value equities will outperform growth equities? Recall, Financials tracks value fairly closely.

- What is your interest rate forecast? How does that affect the yield curve and your outlook for bank lending?

Fisher Investments UK believes that by answering these questions, you can improve the chances you are making an informed decision about your portfolio positioning. Despite falling in significance since the Great Financial Crisis, Financials still represent a significant portion of the global equity market. If you’re investing in a well- diversified equity portfolio, you’ll likely want to have at least some investments in the area.

Interested in planning for your retirement? Get our ongoing insights, starting with a copy of Your Net Worth.

Follow the latest market news and updates from Fisher Investments UK:

This document constitutes the general views of Fisher Investments UK and should not be regarded as personalised investment or tax advice or a reflection of client performance. No assurances are made that Fisher Investments UK will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Nothing herein is intended to be a recommendation or forecast of market conditions. Rather, it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. In addition, no assurances are made regarding the accuracy of any assumptions made in any illustrations herein. Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom. Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[i] Source: Factset. MSCI World Sector Index Price Returns from 31/12/2021 – 10/11/2022. Selected Financial Equity Price Returns from 30/10/2007 – 10/11/2022

[ii] Source: Factset. MSCI World Sector Index Price Returns from 30/10/2007 – 09/03/2009.

Comments