It appears Mark Carney barely escaped writing a letter to Chancellor of the Exchequer Philip Hammond this week: UK inflation remained at 3.0% y/y in October, exactly one percentage point above the BoE’s target. Whilst we imagine Carney and his typewriter are breathing sighs of relief, headlines aren’t: Most observers still believe high inflation is choking the UK economy, putting the expansion (and UK shares) at risk. History and recent data, however, disagree: Britain’s economy and markets have endured higher inflation in the past, and UK consumers are far more resilient than most believe.

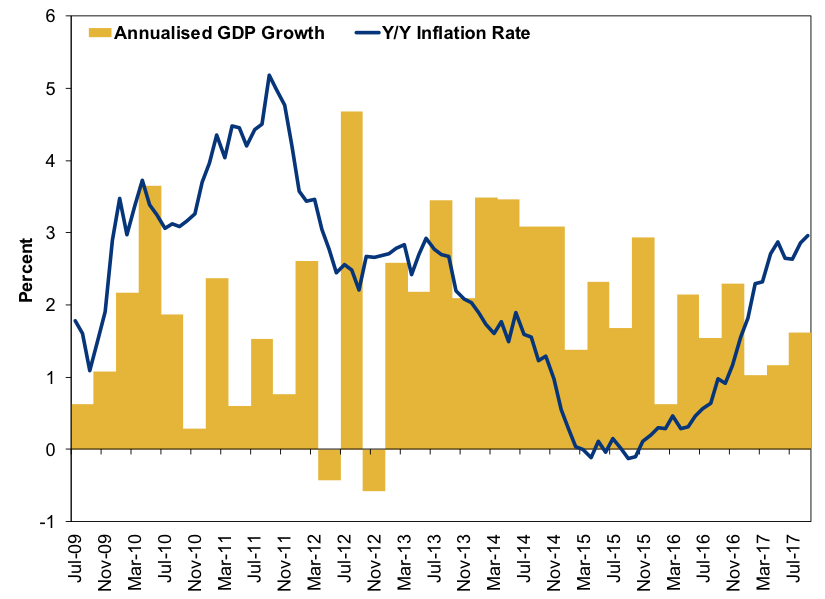

As headlines are quick to point out, inflation is at a five-year high. That sentence cuts both ways. Yes, inflation is higher than at any point in the last five years. However, this also means inflation was higher five years ago. Follow the breadcrumbs, and you see inflation was higher for most of 2010 – 2012. As Exhibit 1 shows, the annual inflation rate first crossed above 3% in January 2010, when it jumped from December 2009’s 2.9% to 3.5%. A year later it hit 4%, and it eventually peaked at 5.2% in September 2011. It didn’t cross back below 3% until May 2012, after the 2011 VAT hike fell out of the calculation.

The UK’s expansion wasn’t the world’s fastest in 2010 – 2012, but it did persist. As Exhibit 1 shows, growth rates were choppy, but GDP contracted only twice: Q2 and Q4 2012. On each occasion, consumer spending wasn’t the culprit. (Exhibit 2) Rather, government spending and fixed investment detracted in Q2 2012, whilst trade detracted in Q4. Consumer spending did fall in Q2 2014, but it seems fair to say January 2011’s VAT hike played a role in that one-off drop.

Exhibit 1: Higher Inflation Didn’t Sink UK GDP

Source: FactSet, as of 14/11/2017.

Exhibit 2: It Didn’t Sink Consumer Spending, Either

Source: FactSet, as of 14/11/2017

UK shares didn’t suffer alongside higher inflation, either, as Exhibit 3 shows. Markets did endure a correction (short, sharp, sentiment-driven drop of -10% or worse) in summer and early autumn 2011, but that was part of a global reaction to the eurozone debt crisis. The recovery from that pullback began months before inflation settled to a more benign rate. UK shares have also held up fine alongside this year’s higher inflation. Though they trail global markets modestly, they are positive for the year. Considering how efficiently capital markets deal with widely known information—and considering the ubiquity of inflation data and related fears over the last year—we believe it is fair to say shares have assessed the risks and moved on. If inflation over 5% couldn’t topple the UK economy, then inflation hovering around 3% probably can’t, either. Also, whilst this is just one data point, inflation also spent much of the mid-to-late 1990s near 3%, and that was a marvelous stretch for Britain’s economy and markets.

Exhibit 3: Inflation Didn’t Sink UK Shares

Source: FactSet, as of 14/11/2017. MSCI UK Index return with gross dividends, monthly, June 2009 – October 2017.

Whilst GDP growth did slow earlier this year as prices rose, more recent data show both trends reversing. In its October purchasing managers’ index (PMI) for UK services, IHS Markit reported a 13-month low in input cost inflation. Of course, other factors—chiefly, supply and demand—impact prices in end-markets, but this is perhaps one sign of easing pressures. Consumer prices may also be easing. Whilst the y/y rates may remain elevated for a few more months due to a low base effect, monthly price increases have slowed. Prices rose just 0.1% m/m in October, slowing from 0.3% in September and 0.6% in August. Most importantly, inflation is always and everywhere a monetary phenomenon: With loan growth and broad money supply growth easing off last year’s rapid growth rates, inflation should also cool.

Meanwhile, there are signs of an economic reacceleration. Services and Manufacturing PMIs have picked up, with both now well above 50, indicating broader expansion. Manufacturing output, which declined in Q2, grew nicely in Q3. Retail sales, though choppy, have grown every quarter this year. Growth in the service sector, where most consumer spending goes, stayed steady at 1.5% annualised in Q3, with all major service industries contributing for the second straight quarter. Yet expectations remain low, with few fathoming a potential economic uptick. This suggests the bar for positive surprise should be easy to clear.

Whilst UK shares have underperformed year to date, we believe they should do well looking forward as the country beats expectations. With sentiment very dour toward both the economy and politics, we think there is plenty of room for positive surprise as economic growth continues and political gridlock keeps legislative risk low.

Investing in equity markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world equity markets and international currency exchange rates.

Follow the latest market news and updates from Fisher Investments UK:

Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited Headquarters: 2nd Floor, 6-10 Whitfield Street, London, W1T 2RE, United Kingdom. Fisher Investments Europe Limited’s parent company, Fisher Asset Management, LLC, trading under the name Fisher Investments, is established in the USA and regulated by the US Securities and Exchange Commission. Investment management services are provided by Fisher Investments.

This document constitutes the general views of Fisher Investments UK and Fisher Investments, and should not be regarded as personalised investment or tax advice or as a representation of their performance or that of their clients. No assurances are made that they will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. In addition, no assurances are made regarding the accuracy of any forecast made herein. Not all past forecasts have been, nor future forecasts may be, as accurate as any contained herein.

For more information, visit fisherinvestments.com/en-gb.

This article is free to read

To unlock more articles, subscribe to get 3 months of unlimited access for just $5

Comments

Join the debate for just $5 for 3 months

Be part of the conversation with other Spectator readers by getting your first three months for $5.

UNLOCK ACCESS Just $5 for 3 monthsAlready a subscriber? Log in