Investors face a real challenge in managing their investments through what is hopefully a long, happy and comfortable retirement. Today, many can expect a retirement of 30 years or more—that means needing your money to work for you for at least that long. If you’re hoping to leave money to a spouse, heir or charitable cause, you’ll need your money to last even longer. Needless to say, the stakes are high. We’ve helped thousands of individuals and families plan for a comfortable retirement, so we know the quality of your retirement depends, in part, on the investment decisions you make today and over the coming years. Below we discuss some of the most common retirement investing mistakes so you can avoid them and plan better for the long term.

Misunderstanding the Risk-Reward Trade-off

The first—and potentially most important—investing mistake we see retirees make is believing they need a cautious, low-volatility strategy focused on fixed interest securities as opposed to equities.

Depending on your investing goals and personal situation, you may need predictable income streams or principal protection over time. So some stable, low-returning investments may be right to include in your portfolio. However, if you need long-term portfolio growth to reach your goals, investing too cautiously could increase the risk you run out of money in retirement.

One common misconception is that fixed interest is safer than equities. Whilst it’s true that fixed interest has often been less volatile than equities over shorter periods, fixed interest also comes with its own, often overlooked risks. For example, default risk is the risk that the fixed interest issuer defaults on the security, in which case, you may not get your entire principal back. Reinvestment risk refers to the potential that your future fixed interest payments may have to be reinvested at a rate lower than your original investment. That could reduce the very income stream you were relying on.

Every investment has an inherent risk-return trade-off, but often investors focus on one risk—volatility—while ignoring others. Equities’ higher long-term returns often come with more volatility. However, if you need long-term growth over a long time horizon, investing too cautiously is another risk you may need to consider.

Instead of trying to avoid any one risk altogether, it’s important to focus on a more holistic view of your goals, personal situation, risk profile and investment time horizon—how long you plan to invest—and let that guide your investing decisions.

Improperly Diversifying

Once you determine which investments you need to reach your goals, you can take steps to mitigate their inherent risks. Diversifying your investments across countries, sectors and individual securities is a tried and true strategy for managing risk. However, we see two common ways investors fail to do this, often without even realizing it.

First, some investors concentrate too much of their portfolio in a single equity and possibly take on more risk than is prudent. Investors may end up doing this when optimism or over confidence makes this action seem safe. For example, you may hold a significant portion of your portfolio in your company’s shares, perhaps because the company has done well for years or because you have a good feeling about their future prospects. Calculations like these may be based more on emotion than on economic fundamentals. If that seemingly stable security becomes volatile or loses significant value, your retirement could be at stake!

Second, some investors attempt to diversify by spreading their money across five or six (or more) funds. However, depending on their underlying holdings, you may end up owning the same securities many times over, leaving you too concentrated in certain companies. This strategy could alternatively leave you over diversified. If each of your funds holds hundreds of different securities, your portfolio could have exposure to thousands of individual companies. After accounting for fund fees, an over-diversified portfolio may lag overall market performance.

Trying to Time the Market

Investing mistakes aren’t limited to choosing securities. They often arise as investors manage their portfolios over time. One mistake we’ve seen time and again is trying to time the market. We know of no one who has been able to consistently and successfully time all market moves. Yet investors still try to time the market to avoid losses in falling markets or capture gains in rising markets. Often they end up making costly mistakes.

For a long-term equity investor, we believe it is prudent to stay invested and stick to your long-term plan unless you have strong reasons to believe the market is in the early stages of a bear market—a prolonged downturn of 20% or greater based on economic and market fundamentals—with most of the losses still ahead. And your reasons must be unclouded by emotion or other biases. Consistently identifying a bear market early on—let alone predicting one before it starts—is extremely difficult, even for professionals.

Then there are corrections—sentiment-driven market drops of about 10% to 20%—which can come without warning, and the recovery that follows can be just as fast. Corrections are sentiment-based and can change rapidly. We don’t believe corrections can be reliably timed—or that they are worth timing because they are so short-lived and the consequences of get the timing wrong can be dire.

Trying to avoid all market negativity can have significant consequences if you’re wrong. (And unfortunately it is probably more a matter of when you’re wrong, rather than if.) Being out of the market can mean missing important up days, which can add up to huge opportunity cost over time.

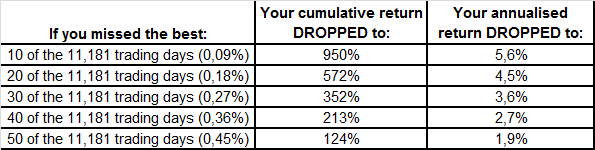

The MSCI World Index (in euros) has grown 1,797% cumulatively from 1976 to 2018, but if you missed just the 10 best days in the market over that period then your cumulative return would drop to 950% and your annualized return would drop from 7.1% to 5.6%![i] If you need long-term growth, missing up days like this could keep you from meeting your goals.

Exhibit 1: What If You Missed the Best Days? (MSCI World Index 1975-2018)

Source: Global Financial Data; as of 9/1/2019; daily MSCI World Total Return Index from 31/12/1975 to 31/12/2018. Returns presented in euros. Currency fluctuations between the Euro and GBP may result in higher or lower investment returns.

Conclusion

Remember, investing successfully for a long retirement depends on staying focused on the long term. Short-term market fluctuations may tempt you to try moving in and out of the market. But timing the market is extremely difficult and risky, and if you try to do so, you may miss out on some of the biggest up days. Similarly, attempting to avoid short-term volatility by investing in fixed interest or other conservative investments may open you up to other potential long-term risks. Diversification also has a long-term logic to it. It’s an effective strategy because no one country, sector or stock outperforms permanently. Keep these common investing mistakes in mind as you plan and invest for your future.

Interested in planning for your retirement? Get our ongoing insights, starting with your free copy of The Definitive Guide to Retirement Income.

Fisher Investments Europe Limited, trading as Fisher Investments UK, is authorised and regulated by the UK Financial Conduct Authority (FCA Number 191609) and is registered in England (Company Number 3850593). Fisher Investments Europe Limited has its registered office at: Level 18, One Canada Square, Canary Wharf, London, E14 5AX, United Kingdom.

Investment management services are provided by Fisher Investments UK’s parent company, Fisher Asset Management, LLC, trading as Fisher Investments, which is established in the US and regulated by the US Securities and Exchange Commission. Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

[1] Source: Global Financial Data; as of 9/1/2019; daily MSCI World Total Return Index from 31/12/1975 to 31/12/2018.

This article is free to read

To unlock more articles, subscribe to get 3 months of unlimited access for just $5

Comments

Join the debate for just $5 for 3 months

Be part of the conversation with other Spectator readers by getting your first three months for $5.

UNLOCK ACCESS Just $5 for 3 monthsAlready a subscriber? Log in