As another £30 billion of taxpayers’ money is handed over to banks, the role of banking sector in the continuing UK recession cannot be understated.

1990s Japan taught the world that developed economies with zombie banking systems don’t grow. Crippled by bad debts, lending margins on solvent borrowers increase, credit availability declines and ongoing bailouts are needed. This hampers growth in the rest of the economy. The more indebted the private sector, the greater the damage a bust banking system inflicts.

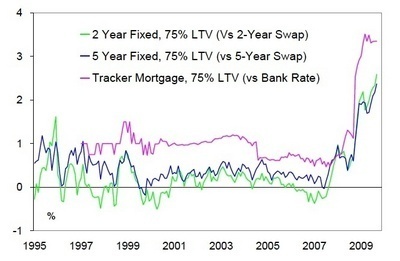

The above chart shows how margins on UK mortgages – the gap between borrowing from the Bank of England and what is then leant to mortgage holders – have soared since September last year. In most other countries mortgage rates fell with the central bank rate: mortgage rates for existing borrowers are between 1% and 2% in much of the rest of Europe now.

Get Britain's best politics newsletters

Register to get The Spectator's insight and opinion straight to your inbox. You can then read two free articles each week.

Already a subscriber? Log in

Comments

Join the debate for just $5 for 3 months

Be part of the conversation with other Spectator readers by getting your first three months for $5.

UNLOCK ACCESS Just $5 for 3 monthsAlready a subscriber? Log in