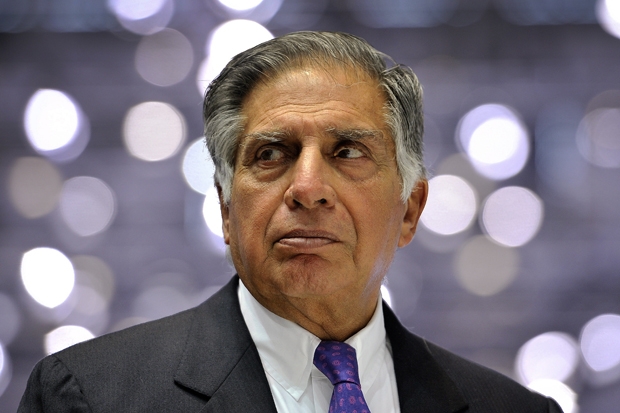

If asked to pick the UK’s inward investor of the century so far I would, without hesitation, name Ratan Tata, the anglophile former patriarch of the eponymous Indian conglomerate that bought Tetley the tea-maker for £271 million in 2000, Corus the Anglo-Dutch steel-maker for £6.2 billion in 2007, and Jaguar Land Rover — from Ford — for £1.3 billion in 2008. We’ve heard a lot lately about Mr Tata’s hubristic folly in buying Corus in the first place; and about his boardroom successors in Mumbai ‘going through the motions’ of finding a buyer for Corus UK —with its Port Talbot blast furnaces symbolising what’s left of our shrunken industrial heritage — while secretly aiming to shut it down to protect Corus’s more modern plant at IJmuiden in Holland, which Tata plans to merge with ThyssenKrupp of Germany, creating a Fortress Europe steel giant to resist the Chinese.

That’s all been made to sound quite sinister, highlighting the peril of relying on footloose foreign capital. Meanwhile David Cameron and out-of-his-depth Sajid Javid are desperate to avert closure of Port Talbot before the EU referendum date in June, lest blame for job losses converts to votes for ‘leave’. But let’s pause amid the frenzy of spin to give credit to Tata where it’s due.

It’s true that the Indians overpaid wildly for Corus, without much due diligence, in a late-night live auction against the Brazilian bidder CSN in which Corus’s advisers could barely believe their luck; and that Tata has failed to make UK Corus viable in increasingly adverse global market conditions. It also happens to be true that Tata underpaid by a wide margin for Jaguar Land Rover (if the prices of the two had been swapped, they would have looked about right) and went on to work miracles with it.

Under Ford’s ownership, JLR had come close to collapse, making barely 150,000 cars a year.

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in