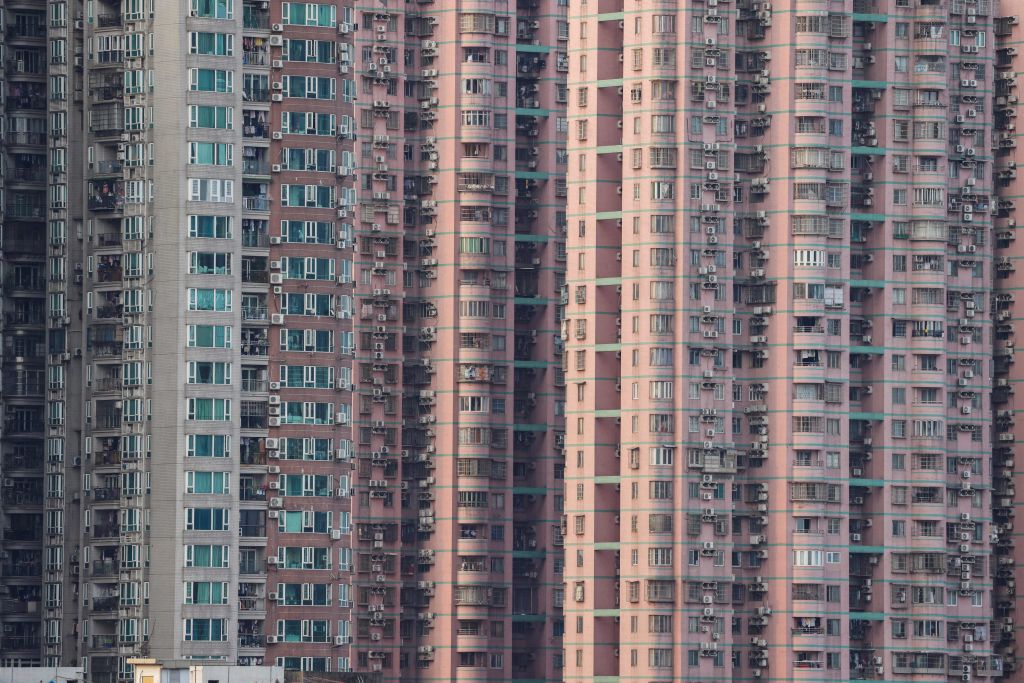

Once, not that long ago, few people outside China had heard of the property developer Evergrande. Now it is synonymous with failure, debt and loss – and seen as the tipping point in China’s real estate market three years ago. Now meet Country Garden, another large property developer, hailed even a year ago as a model ‘corporate citizen’. As of this week, it is a penny stock facing a debt and liquidity crisis, cannot service its US dollar debt, and is on the brink of default. Its financial demise is not quite on the scale of Evergrande, but it comes at a worse moment, when China’s economy is in the eye of a bad economic news storm, consumer and business confidence are fragile, and when the word ‘contagion’ has resurfaced.

The bigger story is that China’s development model is no longer fit for purpose, and hasn’t been for some years

Country Garden and Evergrande are the highest profile failures in China’s beleaguered real estate sector, in which companies like these, accounting for two fifths of Chinese home sales, have defaulted.

Get Britain's best politics newsletters

Register to get The Spectator's insight and opinion straight to your inbox. You can then read two free articles each week.

Already a subscriber? Log in

Comments

Join the debate for just £1 a month

Be part of the conversation with other Spectator readers by getting your first three months for £3.

UNLOCK ACCESS Just £1 a monthAlready a subscriber? Log in