Today’s Budget was horrendously historic in terms of the borrowing it sets out. But even the huge numbers getting bandied around could still prove to be underestimates. The Treasury’s growth figures for 2011 and beyond are stylistic at best – and, if you look back to the recession of the early 90s, the biggest borrowing increases came after the recession was over, in 1993.

Today’s Budget was horrendously historic in terms of the borrowing it sets out. But even the huge numbers getting bandied around could still prove to be underestimates. The Treasury’s growth figures for 2011 and beyond are stylistic at best – and, if you look back to the recession of the early 90s, the biggest borrowing increases came after the recession was over, in 1993.

Despite the fast-deteriorating public finances, the Government still hasn’t spelled out what they’re going to do to get their coffers back in shape. Even allowing for those fanciful forecasts, their “efficiency measures” will get us back to a deficit of 5 percent of GDP in 2013-14. That, sadly, is nowhere near a prudent rate.

You know you only have sustainable debt if the overall stock is around 40 percent of GDP and you’re running a budget deficit of well under 3 percent annually. The Government’s plan would leave us far from that, and the public finances would remain in a precarious state.

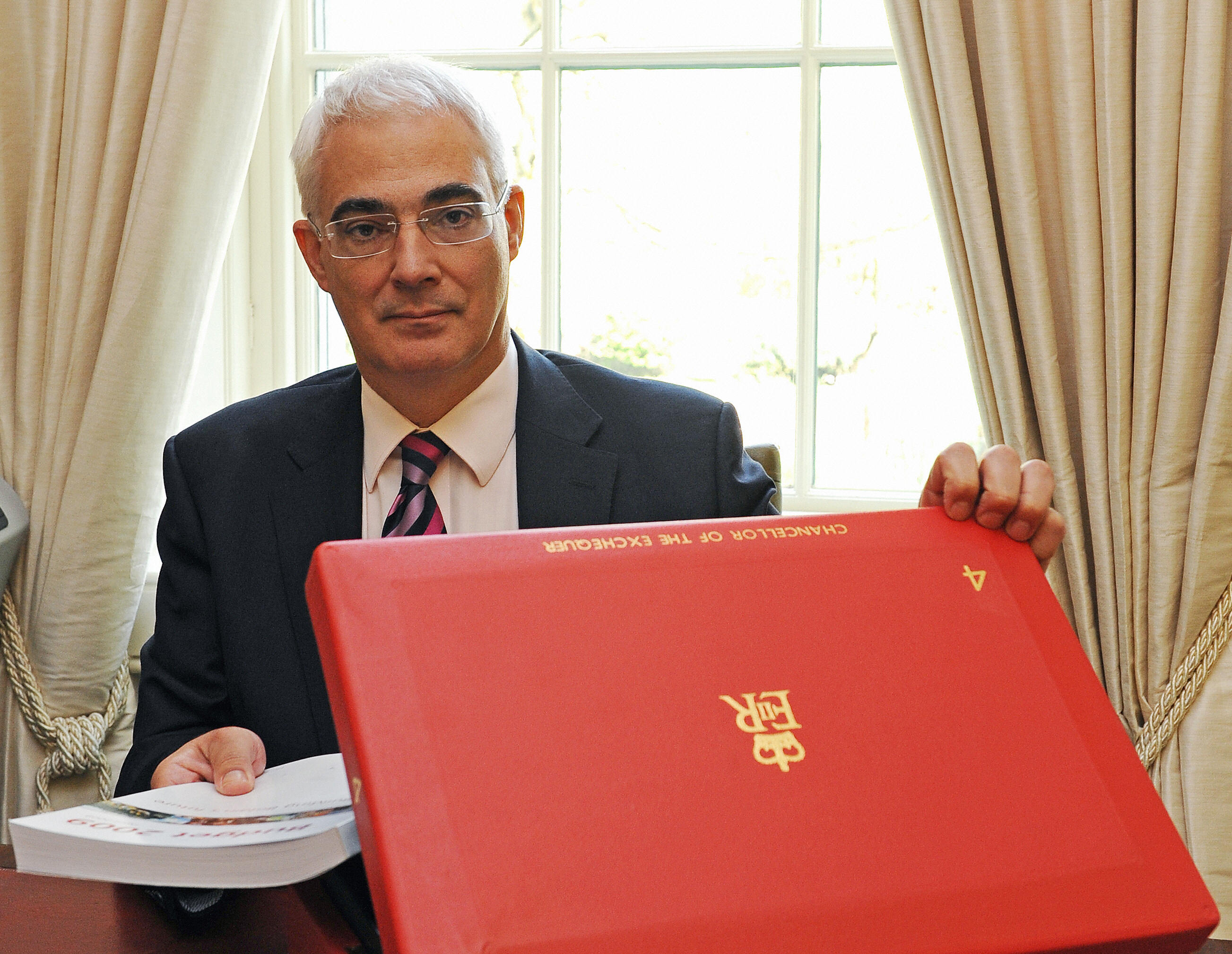

Norman Lamont was Chancellor of the Exchequer between 1990 and 1993.

Comments