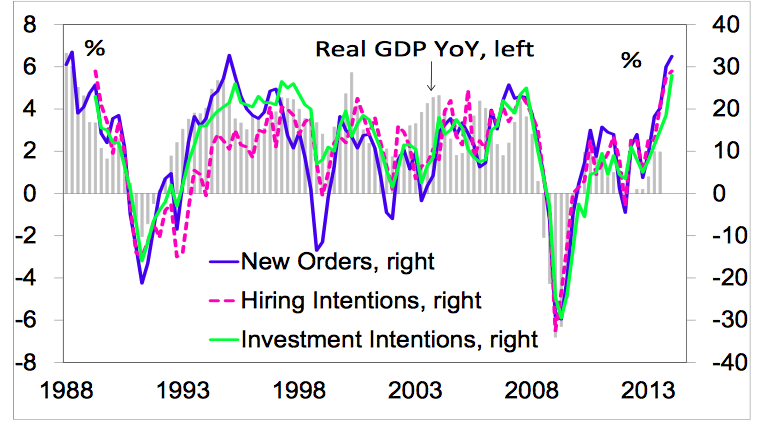

Car sales are up 11pc, making the FT splash  this morning. House prices are soaring again, up 8pc last year. And the British Chamber of Commerce has this morning released its Q4 survey showing a startling surge in investment, orders and employment (graph, above). Good news for George Osborne’s plan for a ‘balanced’ recovery: manufacturers’ capacity use, confidence and employment difficulties are at the highest since the survey began in 1988. The upshot, as Citi says (pdf) is that the UK economy will likely grow far faster this year than Osborne’s cautious official expectation. He will most likely have another healthy upgrade to announce in his next budget. Citi expects growth of more than 3 per cent this year.

this morning. House prices are soaring again, up 8pc last year. And the British Chamber of Commerce has this morning released its Q4 survey showing a startling surge in investment, orders and employment (graph, above). Good news for George Osborne’s plan for a ‘balanced’ recovery: manufacturers’ capacity use, confidence and employment difficulties are at the highest since the survey began in 1988. The upshot, as Citi says (pdf) is that the UK economy will likely grow far faster this year than Osborne’s cautious official expectation. He will most likely have another healthy upgrade to announce in his next budget. Citi expects growth of more than 3 per cent this year.

Mark Carney, the Bank of England governor, should be eyeing all this nervously: if the BCC survey is at the highest in its 25-year history, why are British interest rates at emergency life support levels? Isn’t he just pouring more vodka in the punch bowl? And might he be re-inflating the bubble that got us into all this mess in the first place?

The car sales, for example, are driven by cheap financing. Nationwide said last week that the house prices are being buoyed by ‘ultra-low’ mortgage rates. And the Chancellor still wants the taxpayer to subsidise first-time buyers through his deeply controversial ‘help to buy’ scheme.

Britain does appear to be booming. And it’s becoming harder than ever to justify why base interest rates are at 0.5 per cent – as the Telegraph’s Jeremy Warner has said. Until they rise, it’s hard to look at the current recovery without worrying how much of it is real, and how much another debt-fuelled illusion.

Comments