Almost three years after promising a plan to tackle Britain’s regional inequalities, Boris Johnson unveiled his long- awaited report on ‘levelling up’ earlier this year – with a 325-page dossier setting out a number of binding ‘missions’ for the various levers of the British state. But in its sprawling focus on ‘rewiring the Whitehall machine’, does this flagship manifesto overlook the real driver of economic prosperity – namely, the all-powerful private sector?

That was the question at the top of the agenda when The Spectator hosted a special boardroom lunch – in partnership with the British Private Equity and Venture Capital Association (BVCA) – to discuss something that was proving increasingly elusive in British politics: economic growth. Could Britain’s vast pool of private equity and venture capital investment (£102 billion of GDP was generated by these types of British businesses last year) hold the key to getting the economy roaring again?

If the stereotypical headlines about US-led company buyouts were anything to go by, the private capital industry might not seem a natural bedfellow of the ‘levelling up’ agenda. Yet the BVCA’s director-general Michael Moore (a former Scotland secretary in the coalition government) insisted that the industry was in fact a crucial driver of regional prosperity – including in those ‘left behind’ parts of Britain – creating jobs and scaling up businesses.

‘If you look at the capital our members invested in 2020 – both in terms of private equity and venture capital – around two-thirds of it was actually outside London and the south-east,’ Moore said. ‘Half of the jobs backed by private capital – around two million jobs in total – are outside London.’ What’s more, he said, around 90 per cent of businesses backed by BVCA members were small and medium-sized enterprises which want to grow – and are looking for the guidance and expertise of seasoned investors (as well as financial backing) to help them do so.

Rather than the unacceptable face of capitalism, Moore said, private equity firms and the businesses they invest in are increasingly the ‘unsung heroes’ of economic growth. Indeed as one private equity partner (from a mid-market firm based in the Midlands) around the table explained, most of the businesses his firm bought ended up doubling their workforce – despite the inaccurate (yet frustratingly persistent) perception that private equity investment means slashing jobs.

The vast wave of investment from private equity and venture capital investments certainly hadn’t gone unnoticed in Whitehall – with the Treasury reportedly keen to encourage both private and institutional capital to back some of its own pet projects. The Spectator’s editor Fraser Nelson recalled a rather extraordinary open letter in which the former chancellor and Prime Minister reassured big institutional investors that they would break down barriers they face when investing in illiquid assets (including private equity and venture capital funds) to encourage greater investment in innovation and growing buisnesses.

And what about the government’s other big idea – using its muscle to incentivise private investors to back UK companies with high growth potential, aiming to make Britain a science and technology ‘superpower’? Conservative parliamentarians in the room – including David Davis, Steve Baker and Bob Neill – were largely of the opinion that a Tory government had no business ‘picking winners’. Totnes MP Anthony Mangall went even further: ‘We have this appalling instinct in the party now to just regulate things more and more,’ he said – a point met with some nods round the table.

Yet Moore maintained that – while scepticism about government overreach was legitimate – there was a welcome role for Whitehall in steering investment. In reference to the British Business Bank, he said: ‘One thing the government can do is provide a due diligence premium by showing it has confidence in a particular business.’ In some cases, there may even be a justification for the state acting as a ‘first mover’: with a Bristol based private equity and venture capital partner explaining how her firm had been tasked with managing the Northern Powerhouse Investment Fund, a taxpayer-backed vehicle intended to close the business funding gap in the north.

The most important thing, said one of the private equity voices, was for the government to take a more welcoming approach towards wealth creators and those that help to fund them, including private capital– and think twice about some of its business-bashing proposals. It was a point quickly expanded on by BVCA’s Sara Rajeswaran. ‘The entrepreneurs I’ve worked with want to grow and scale their businesses, but they also tend to have a lot of local pride – and a desire to create jobs in their towns and cities,’ she said.

Even if only a small number of those businesses succeeded, it was hard to argue with the fundamentals: their long-term track record for ‘levelling up’ was still better than that of any recent government – whether that be in the UK or elsewhere. And to overlook that all-important fact would be to the next prime minister’s – and Whitehall’s – peril.

Charts:

Jobs supported by private equity/venture capital in the UK

London – 599,000 (31 per cent of total)

South-east – 256,000 (13 per cent of total)

North-west – 171,000 (9 per cent of total)

East of England – 147,000 (8 per cent of total)

Scotland – 133,000 (7 per cent of total)

West midlands – 127,000 (7 per cent of total)

South-west – 118,000 (6 per cent of total)

Yorkshire and the Humber – 117,000 (7 per cent of total)

East midlands – 103,000 (5 per cent of total)

Wales – 60,000 (3 per cent of total)

North-east – 50,000 (3 per cent of total)

Northern Ireland – 38,000 (2 per cent of total)

Source: BVCA

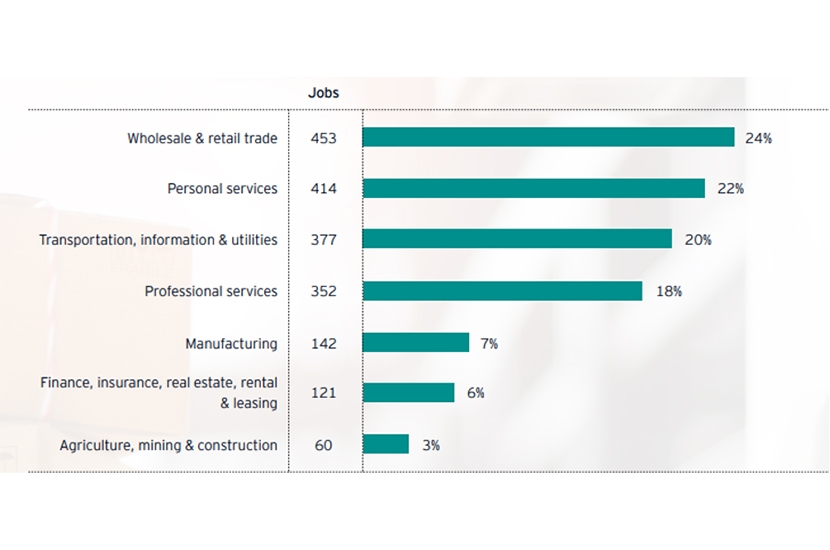

UK jobs supported by PE/VC by sector:

Source: BVCA

This article is free to read

To unlock more articles, subscribe to get 3 months of unlimited access for just $5

Comments

Join the debate for just $5 for 3 months

Be part of the conversation with other Spectator readers by getting your first three months for $5.

UNLOCK ACCESS Just $5 for 3 monthsAlready a subscriber? Log in